Secure Your Financial Future Using Leverage Today

Join the webinar and learn how you CAN RETIRE WITH MORE MONEY, MORE PROTECTION, and more confidence.

💡 This strategy is designed for individuals with household incomes of $100,000 or more.

Secure your spot today before seats fill up!

It's Time for a New Approach

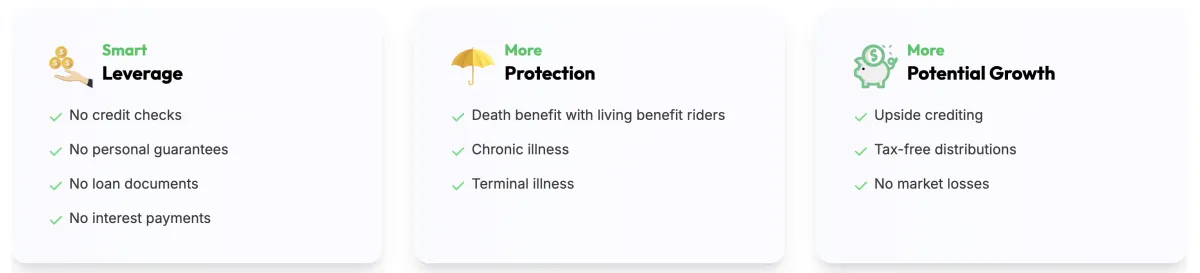

Your retirement success depends on how much you save-not just your rate of return. By leveraging a uniquely designed, cash-accumulating life insurance policy, you can access additional funds for accelerated growth potential, all while avoiding the risks of market downturns. This strategy not only protects you and your family but also secures the loan, offering the potential to increase your retirement savings significantly, without the typical risks associated with leverage.

With an annual income of $150,000, financial experts estimate you’ll need approximately $1.5 million in savings to maintain your current lifestyle during retirement. However, 96.8% of retirees today fall short of even $1 million in savings, leaving many to face tough choices like delaying retirement or significantly reducing their spending.

(Source - Fuchs Financial)

WHY USING LEVERAGE IS SMART

We often use leverage to afford a better home or a higher-quality car. Kai-Zen takes this concept further by using leverage to help you achieve greater growth and enhanced protection, all while allowing you to maintain your current standard of living. This is leveraging done the smart way.

Got Questions?

We've got answers

Why was Kai-Zen® Developed?

When my partners and I started our business, we poured everything into it—our time, energy, and savings—thinking success would come quickly. But it took years of uncertainty before we finally reached financial stability. By then, we realized how far behind we were on retirement savings. The numbers were daunting—statistically, we’d need to live on our savings for 22+ years, requiring us to put away 30-40% of our income, which just wasn’t realistic with a mortgage, taxes, and kids. That’s when we started looking more closely at why our wealthy clients were using leverage & life insurance to build, preserve and transfer more of their wealth, and we asked ourselves: Why couldn’t we do the same? We knew life insurance was one of the safest assets for securing a loan, even more so than a house. So, we built a plan that used only what we were already willing to save and leveraged it in a way that minimized our lender risk while maximizing the policy potential cash accumulation. We ran stress tests, consulted CPAs and banks, and had life carriers verify its resilience—and when their results matched or exceeded ours, we knew we had something solid. Today, we have multiple Kai-Zen plans for ourselves, our children, our employees and even extended family. It has given us peace of mind knowing that no matter what happens in the future, we have a safety net in place—not just for us, but for generations of family.

It Almost Sounds Too Good to be True. What’s the catch?

Why Lenders Trust Kai-Zen Without The Need For Participants To Be Financially Underwritten For The Loan: Lenders make loans every day, and most of us have borrowed at some point. But what makes Kai-Zen’s loan structure unique is that it doesn’t require financial underwriting, personal guarantees, or participant loan documentation—which may seem too good to be true. The reason lenders confidently offer this type of loan is their deep understanding of the underlying asset—the IUL policy and the participant’s contributions—which secures the loan. Here’s what makes it so secure: Principal Protections - The IUL policy is designed to safeguard the lender’s funds. Client Contributions - These cover costs and add another layer of protection. Independent Oversight - A third-party trustee monitors the loan annually. Built for Stability - Kai-Zen is structured to withstand economic volatility, with ongoing optimization, monitoring, and servicing until the loan is fully repaid. Very few financial assets provide this level of lender confidence, making Kai-Zen a truly one-of-a-kind strategy.

What are the Qualification Requirements?

While the life insurance carrier may have their own income or net worth qualifications the following is the minimum. Employer offering employee benefits: Employee income $100,000 (100% employer paid group plans could be lower. Contact your agent for more information) Individuals - Household income $200,000. Ages - 18-65. Health - Average or better (Some younger ages with below average health could be eligible. Contact your agent for assistance).

Do I Need to Apply for the Loan?

No. There is no loan application or loan underwriting. The loan is a commercial loan that is made to the Master Trust. Your 5 annual contributions and the policy are assigned to the lender and the sole collateral for the loan.